The Mera Ghar Mera Ashiana Loan Scheme 2025 is a government housing loan program designed to help first-time home buyers in Pakistan. This initiative by the Government of Pakistan offers affordable home loans to low- and middle-income families who dream of owning their own house. Under this scheme, eligible people can buy or build a home with easy monthly installments, low markup rates, and long repayment tenures of up to 20 years. It is supported by major commercial banks, Islamic banks, microfinance institutions, and HBFCL (House Building Finance Company Limited).

This government home loan in Pakistan comes with a markup subsidy, which helps reduce your monthly EMI, making it easier to manage your budget while owning your first home.

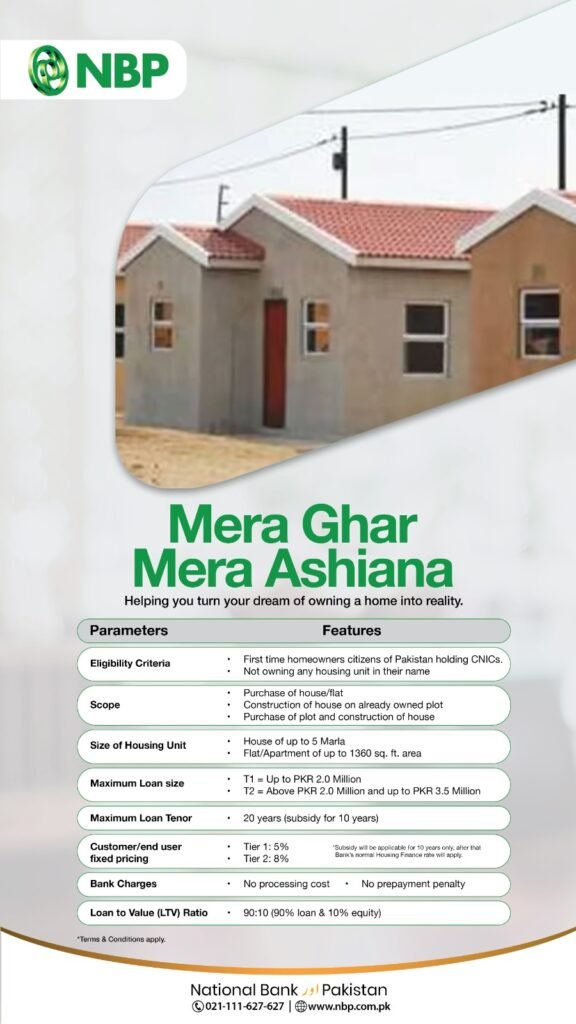

Mera Ghar Mera Ashiana Quick Details

| Category | Details |

|---|---|

| Program Name | Mera Ghar Mera Ashiana Loan Scheme 2025 |

| Target Group | First-time home buyers (low/middle income) |

| Property Limit | Up to 5 Marla or 1,360 sq. ft. |

| Loan Amount | Up to PKR 3.5 million |

| Markup Rate | 5% (Tier-1) / 8% (Tier-2) – first 10 years |

| Tenure | Up to 20 years |

| Down Payment | Around 10% |

| Official Website | https://www.sbp.org.pk |

Why the Mera Ghar Mera Ashiana Scheme 2025 Matters

The Mera Ghar Mera Ashiana Housing Scheme is one of the most affordable home loan programs in Pakistan. It helps people who don’t already own property get access to easy government-backed housing finance. Through this initiative, more families can achieve home ownership without heavy financial pressure.

Key benefits of the Mera Ghar Mera Ashiana Scheme 2025:

- Low markup rates – 5% and 8% for the first 10 years

- Easy installment plans for up to 20 years

- Government subsidy that lowers your cost

- Shariah-compliant (Islamic banking) options available

- No prepayment penalty (depending on bank policy)

This home loan Pakistan 2025 program gives people financial stability and a real chance to own a safe, affordable home.

Eligibility Criteria for Mera Ghar Mera Ashiana Loan

To apply for the Mera Ghar Mera Ashiana Loan Scheme 2025, you must fulfill certain eligibility conditions set by the State Bank of Pakistan (SBP). The program is made for first-time home buyers only.

Applicants must:

- Be a Pakistani citizen with a valid CNIC

- Have no house or flat registered in their name

- Own or plan to buy a property up to 5 Marla or 1,360 sq. ft.

- Show verifiable income (salary, business, or self-employment)

- Have an active bank account with a participating bank

- Apply for personal residential use, not for investment

Banks will review your income stability and debt-to-income ratio to confirm you can afford monthly payments. This ensures that your home loan Pakistan 2025 application is approved smoothly.

Loan Tiers and Markup Rates Under the Scheme

The Mera Ghar Mera Ashiana Loan Scheme 2025 is divided into two loan tiers to support different income levels. Each tier offers fixed markup rates for the first 10 years, making your home financing in Pakistan predictable and easy to plan.

- Tier 1: Loan up to PKR 2 million at 5% fixed markup

- Tier 2: Loan from PKR 2 million to PKR 3.5 million at 8% fixed markup

Other features of this government home loan:

- Maximum tenure: 20 years

- Down payment: Around 10% (varies by bank)

- Government subsidy: Helps reduce overall markup cost

This tier-based structure allows flexibility for both small houses and apartments within the Mera Ghar Mera Ashiana housing scheme 2025 limits.

Required Documents for Mera Ghar Mera Ashiana Loan

When applying for your government home loan Pakistan 2025, make sure to have all required documents ready. Incomplete or unclear documentation is the most common cause of loan delays.

Document checklist for Mera Ghar Mera Ashiana application:

- CNIC of applicant and co-applicant

- Recent photographs

- Proof of income (salary slips, business records, or tax return)

- Proof of residence (utility bill or rent agreement)

- Property ownership documents (title, map, or approved plan)

- Affidavit of no prior home ownership

- Bank account details for EMI payment setup

Make sure your name and address match across all documents for faster approval of your Mera Ghar Mera Ashiana loan.

How to Apply for Mera Ghar Mera Ashiana Loan 2025

The Mera Ghar Mera Ashiana Loan can be applied for both online and in-branch depending on your convenience. The process is simple, quick, and available across Pakistan.

Online Application Process:

- Visit the official bank website or HBFCL portal

- Go to the Mera Ghar Mera Ashiana Loan Scheme section

- Fill in your personal, income, and property details

- Upload your documents clearly and submit the form

- Save your reference number for tracking

- Wait for verification or property valuation by the bank

In-Branch Process:

- Visit a participating bank branch

- Ask for the Mera Ghar Mera Ashiana application form

- Complete your KYC and documentation process

- Submit your file for review and verification

Applying through banks that are active in housing finance Pakistan ensures faster approval and better support.

Tips for Fast Loan Approval

To get quick approval for your Mera Ghar Mera Ashiana Loan 2025, make sure your financial profile and documentation are accurate.

Follow these expert tips for success:

- Keep name spelling consistent on all records

- Avoid new loans before applying

- Maintain a healthy debt-to-income ratio

- Submit complete property documents

- Respond quickly to bank verification calls or visits

Banks prefer applicants who are financially stable and transparent, which increases your chance of getting your home loan approved under this government housing scheme 2025.

Conclusion

The Mera Ghar Mera Ashiana Loan Scheme 2025 is one of the most beneficial housing finance programs in Pakistan. It helps low and middle-income families fulfill their dream of owning a house with easy monthly installments, low markup rates, and government subsidy. By applying through authorized banks or HBFCL, you can build or buy your own home without financial stress. Always check eligibility, keep documents ready, and apply only through official channels for the safest experience.

Frequently Asked Questions (FAQ)

1. What is the Mera Ghar Mera Ashiana Loan Scheme 2025?

It’s a government-backed home loan program that gives affordable housing finance to first-time buyers in Pakistan, with markup rates of 5% and 8% for the first 10 years.

2. Who can apply for this housing loan?

Any Pakistani citizen with a valid CNIC, no existing home, and verifiable income can apply for the Mera Ghar Mera Ashiana Scheme 2025.

3. How much loan can I get under this scheme?

You can borrow up to PKR 2 million at 5% (Tier-1) or up to PKR 3.5 million at 8% (Tier-2), repayable over 20 years.

4. How can I apply online for the Mera Ghar Mera Ashiana Loan?

Visit your bank’s official website or the HBFCL portal, fill out the online loan form, upload documents, and track your application using the given reference number.