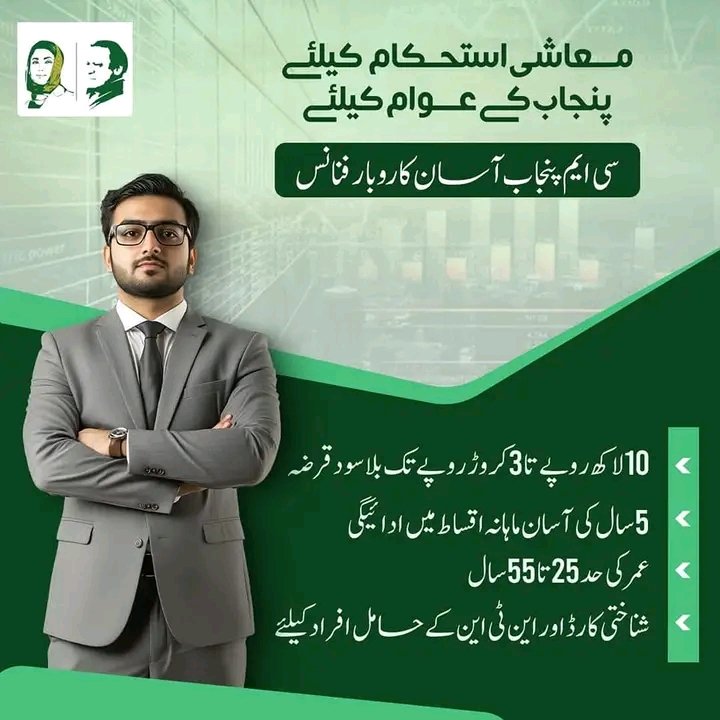

The CM Punjab Business Scheme 2025 is a new initiative by the Government of Punjab to provide interest-free loans for small business owners and startups. Eligible entrepreneurs can receive up to PKR 1 million through a Digital SME Card. This scheme allows young and existing business owners to grow their businesses without worrying about high interest rates. The entire process is digital and online, making it fast, safe, and transparent for all applicants.

| Feature | Details |

|---|---|

| Scheme Name | CM Punjab Business Scheme 2025 |

| Loan Type | Interest-Free Loan via Digital SME Card |

| Maximum Loan | PKR 1 Million |

| Loan Tenure | 3 Years |

| Grace Period | 3 Months before repayment |

| Repayment | 24 Equal Monthly Installments |

| Processing Fee | PKR 500 Non-Refundable |

| Annual Card Fee | PKR 25,000 + FED |

Benefits of Punjab Interest-Free Loans for Startups

The Punjab interest-free loan is designed to help small businesses grow quickly and safely. Borrowers can use funds for daily business needs and digital transactions. Key benefits include:

- 100% interest-free loan with no hidden charges

- Digital SME Card for easy, secure payments

- Promotes a cashless economy and digital business operations

- Encourages youth and women entrepreneurs to start new businesses

- Flexible repayment over 24 months with a grace period

- Transparent process with no middlemen

This scheme ensures entrepreneurs can grow their businesses responsibly while maintaining financial discipline.

Eligibility Criteria for CM Punjab Business Scheme 2025

To qualify for the CM Punjab Business Scheme 2025, applicants must meet these requirements:

- Be a Pakistani citizen residing in Punjab

- Age between 21 and 57 years

- Have a valid CNIC and registered mobile number

- Own or plan to start a business in Punjab

- Have a clean credit history with no overdue loans

- Pass digital credit and psychometric assessments

- Submit only one application per person or business

These criteria make sure that only genuine and responsible entrepreneurs benefit from the scheme.

How to Apply Online for Punjab Interest-Free Loan

The application process for the CM Punjab Business Scheme 2025 is simple, fully digital, and secure. Follow these steps to apply:

- Visit the official portal: https://akc.punjab.gov.pk/cmpunjabfinance

- Fill in your personal and business details

- Pay the PKR 500 non-refundable processing fee

- Complete digital verification of CNIC and business information

- Wait for approval updates via SMS or portal login

- Authorized agencies will verify your business premises digitally and physically

After approval, applicants receive a Digital SME Card to access the loan amount safely.

Loan Usage and Repayment Terms

The Digital SME Card ensures that loan funds are used efficiently and responsibly. Funds can be spent on:

- Vendor and supplier payments

- Utility bills, taxes, and government fees

- POS and mobile transactions for business operations

- Cash withdrawals up to 25% of the limit for business expenses

Repayment rules include:

- First 50% of the loan is available in the first 6 months

- Borrowers must pay at least 5% of the outstanding balance monthly

- Remaining 50% is released after regular repayments

- Total repayment is completed in 24 equal monthly installments after a 3-month grace period

This ensures that funds are used strictly for business purposes and promote long-term growth.

Verification, Security, and Support

The Government of Punjab ensures that the CM Punjab Business Scheme 2025 is secure and transparent.

- Security: Digital personal guarantee and life insurance are mandatory

- Verification: Conducted digitally and physically by the Urban Unit

- Support services:

- Free feasibility reports on PSIC and BOP websites

- Helpline 1786 for guidance

- Non-business transactions are blocked automatically

These measures protect both the borrower and the government, ensuring safe and responsible loan use.

Conclusion

The CM Punjab Business Scheme 2025 is a golden opportunity for small businesses and startups in Punjab. It provides interest-free loans, digital transactions, and structured repayment through the Digital SME Card. Entrepreneurs can use this program to expand their businesses, contribute to a cashless economy, and maintain financial discipline. Eligible applicants can apply online via the official portal for a fast, secure, and convenient process.

FAQ

1. What is the maximum loan under the CM Punjab Business Scheme 2025?

The maximum loan is PKR 1 million through the Digital SME Card.

2. Is the Punjab startup loan interest-free?

Yes, this loan is completely interest-free for eligible business owners.

3. How can I apply for the Punjab interest-free loan?

You can apply online through the official portal: https://akc.punjab.gov.pk/cmpunjabfinance

4. What is the repayment period for this loan?

The loan is repaid in 24 equal monthly installments after a 3-month grace period.